blog

January 10, 2023

TRADE COPIER - SIERRA CHART native capabilities

Sierra Chart has furthered its abilities to include Trade Copying. This function is able to replicate trade executions within accounts from the same broker / data provider.

This is an absolute game changer for traders who:

- Manage a sole account but also manage family accounts

- Operate under a Prop Firm with multiple accounts (sim and/or funded)

The typical Prop Trader using other charting software such as Ninjatrader, requires third party software for Trade Copying at additional expense. Trade Copying is included free with Sierra for a seamless solution once easily connected to Rithmic Data.

I like to say that Prop Firms provide cheap capital to good traders and make bad traders pay real money to trade on a simulator. Regardless, APEX Trader Funding is the best in the business at providing capital to traders with the most fair rules in the business. Cheap capital, if you cant trade within the rules, you have bigger issues.

Use this coupon code to get a discount on a trade evaluation, hell, get a bunch of them and copy the trades….make it worth the effort.

https://apextraderfunding.com/member/aff/go/dutchdaniels?c=SAVE50

This video provides instruction on how to build a Trade Copier Chartbook:

June 27, 2020

"Ain't nobody got time for that!" - Optimize Sierra Chart for SPEED

If setup properly, Sierra Chart is capable of utilizing the god given horsepower of modern PC’s by splitting the load amongst its processing cores. Furthermore, we can prioritize processing speed to the critical execution charts we rely on (for Scalping) and keep the higher time frame charts slightly less “speedy” to limit their PC drain.

To do this, we need to use two Instances of Sierra Chart to spread the load. To add a second Instance:

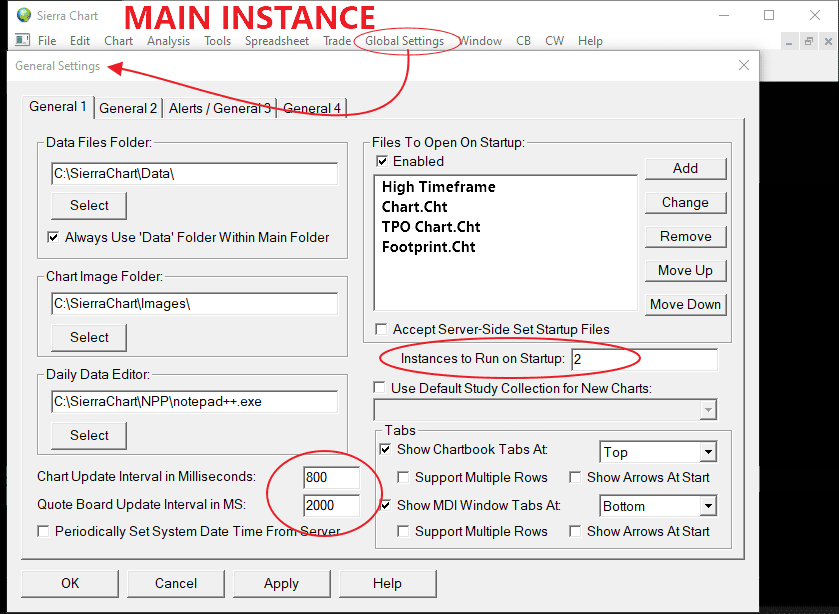

A duplicate instance of Sierra will load. You now have a Main Instance and a Sub Instance. In the Main Instance, I like to keep the Higher Timeframe chartbooks with the update intervals no faster than 800ms (and the quoteboard can be very slow for all I care). The values set here will be the Default for all charts in that instance.

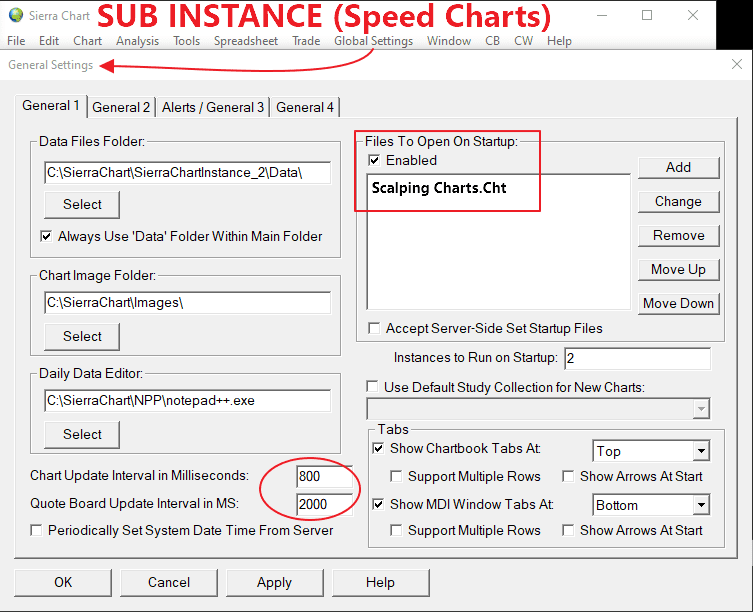

For the Sub Instance do the same, although here I keep it to strictly the Scalping chartbook that I want to optimize.

Finally, on the Execution chart to be optimized, I use 10ms for the update speed (Sierra recommends higher, but I haven’t had an issue). By entering an Update Value on an individual chart, we override the Default speed that we input in the General Settings. This can also be done to the DOM if you use one, but you don’t want to “Optimize” too many charts or the PC will strain.

This will have a dramatic impact to the performance of your charting. See Sierra for further guidance: https://www.sierrachart.com/index.php?page=doc/NewInstance.php#:~:text=The%20first%20time%20a%20new,new%20instance%20of%20Sierra%20Chart.

-ST

Dec. 21, 2019

Trade Faster via Quick Keys, or be a dumb bastard

Typical order entry and manipulation is done via mouse, this is fine and dandy, but this act also requires eyes to be on the mouse cursor as well as the data box to be clicked on during those vital seconds of decision making, diverting eyes from price charts or the DOM.

The issue I have is that your eye cannot be focused on two places at the same time. Scalpers, I’m talking to you, HTF guys should probably look away and prepare your next joke about scalpers.

For us scalpers, seconds can feel like hours and I got tired of focusing my sight picture on anything but the vital information. So, I looked into Quick Keys, not a revolutionary idea by any stretch but they have made life so much better and I want to bore you with details.

First step, you gotta create the keys. This is rather simple, navigate to the Global Setting > Customize Keyboard Shortcuts > then select your command. Something like this:

Shouldnt be too many commands, my master key is something like this. Commands used often are closest by hand, geometrically.

For DOM users, these quick-keys are mandatory. Clearing the recent orders and centering the DOM periodically via keypad is an absolute must, its not even up for debate. Anyone doing these tasks by hand will always be 1/2 second behind and suffer the distraction cost.

So kind of and odd post, but something I think should bring value to some.

-ST

Nov. 19, 2019

ES at a Glance

Looking forward; the 3121 area acted as a pivot on Monday, this may be an area of interest to watch for reactions in the next few sessions. Trapping Shorts and puking them out over previous highs aka “BTFD” will continue to be the game until its not. Overhead targets are the Sunday high 3127.75 and basically any new high that forms for that matter. Not too excited about Shorts until price holds below 3110, although dont want to rule out small scalps below 3121 given favorable order flow. Not much else on my radar.

Nov. 10, 2019

ES Review and Look Ahead (Blog Post #4)

Bull Market behavior continues, third week of One Time Framing higher. Dips at support are being bought and pushed to new all time highs regularly.

Look Ahead:

Oct. 16, 2019

ES Review and Look Ahead

Notable dip at prior weeks pivotal support near the 2955 handle during Globex Sunday. Monday being a quasi holiday had a tight range, spending the better part of the RTH session trapping shorts against the 2965 support. Price is coiled up here waiting for the next news headline to toke panic.

Look Ahead:

Sep. 29, 2019 ES Review and Look Ahead

At the mercy of News Events. Last week saw sell pressure from the prior week Buy-Imbalance area near POC where the first news event drove price thru the 2980 stops, loaded shorts around 2960 and squeezed in a news event, rinse repeat below 3000 on Friday.

Look Ahead:

Sep. 22, 2019 ES Review and Look Ahead

Last week was largely contained within the previous weeks low usage area with multiple rejections on either side. The resulting bid/ask profile is balanced with predominantly aggressive shorts below 3000 and predominantly aggressive longs above 3000.

Below is the weekly TPO look and a detailed Footprint look at the most recent rejection of 3018 which occured on Friday.